Tether Becomes World’s Largest Private Gold Holder

Tether Becomes World’s Largest Private Gold Holder

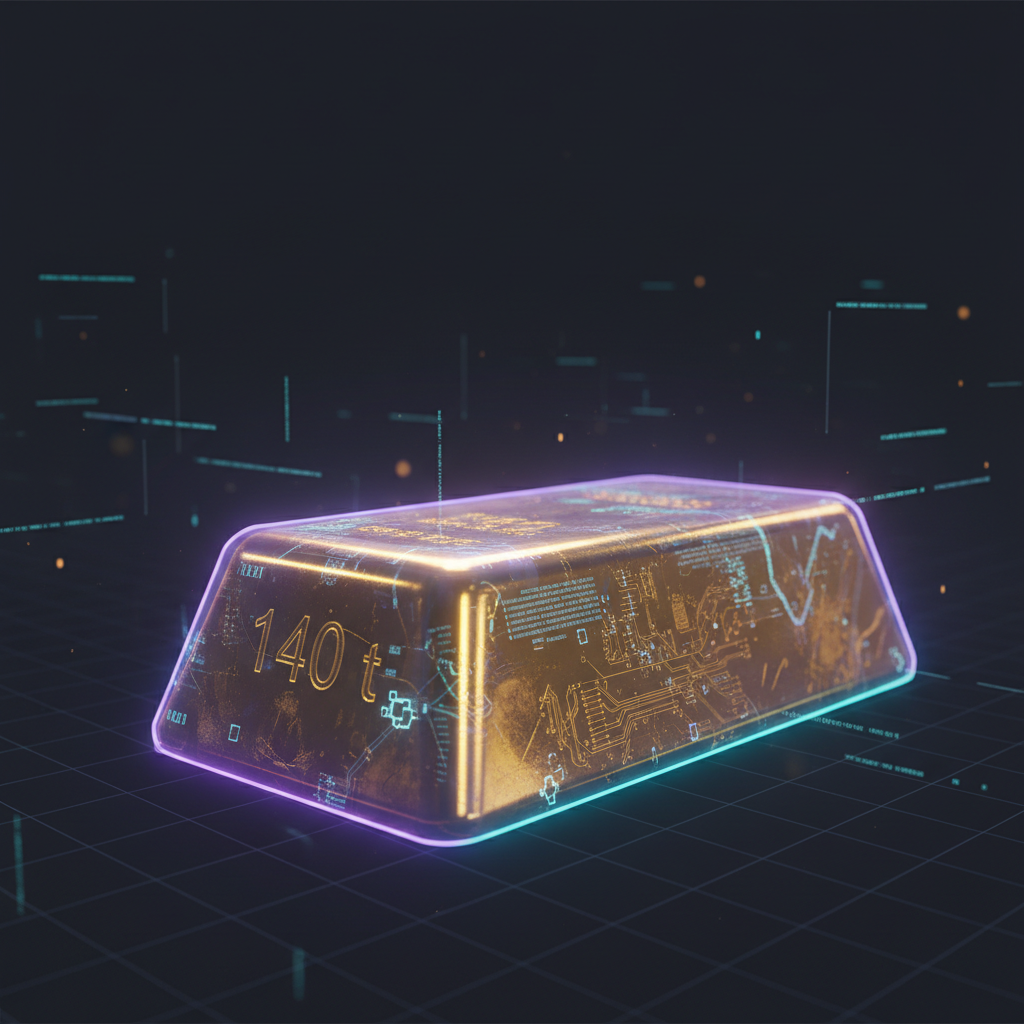

Tether has accumulated more than 140 tonnes of physical gold valued at about $24 billion, making it the largest known private holder outside state and banking sectors.

Reserves and comparative scale

By volume of reserves, the company now surpasses official gold holdings of several countries, including Australia and Saudi Arabia, according to published figures.

The reported stockpile exceeds the scale typical for non-state actors and places Tether among significant global market participants in physical bullion storage and custody.

Strategy and market plans

Chief technology officer Paolo Ardoino described the approach as a quasi-central-bank strategy and framed gold as a critical asset amid rising geopolitical instability and declining trust in fiat currencies.

«quasi-central-bank strategy»

Ardoino indicated that Tether intends not only to store the metal but to engage in active trading, positioning the company to compete with major banks in bullion markets.

These developments reflect a broader trend of crypto firms diversifying reserves into tangible assets, which could affect liquidity and price dynamics in the global gold market.

Implications for transparency and oversight

The growth of private holdings at this scale raises questions about custody practices, regulatory oversight and reporting standards for non-bank entities managing strategic physical assets.

Market participants and observers will likely monitor declarations, audit procedures and trading activity to assess potential impacts on supply, demand and price formation.

Related posts