Exchange flows linked to $RIVER token distribution

Exchange flows linked to $RIVER token distribution

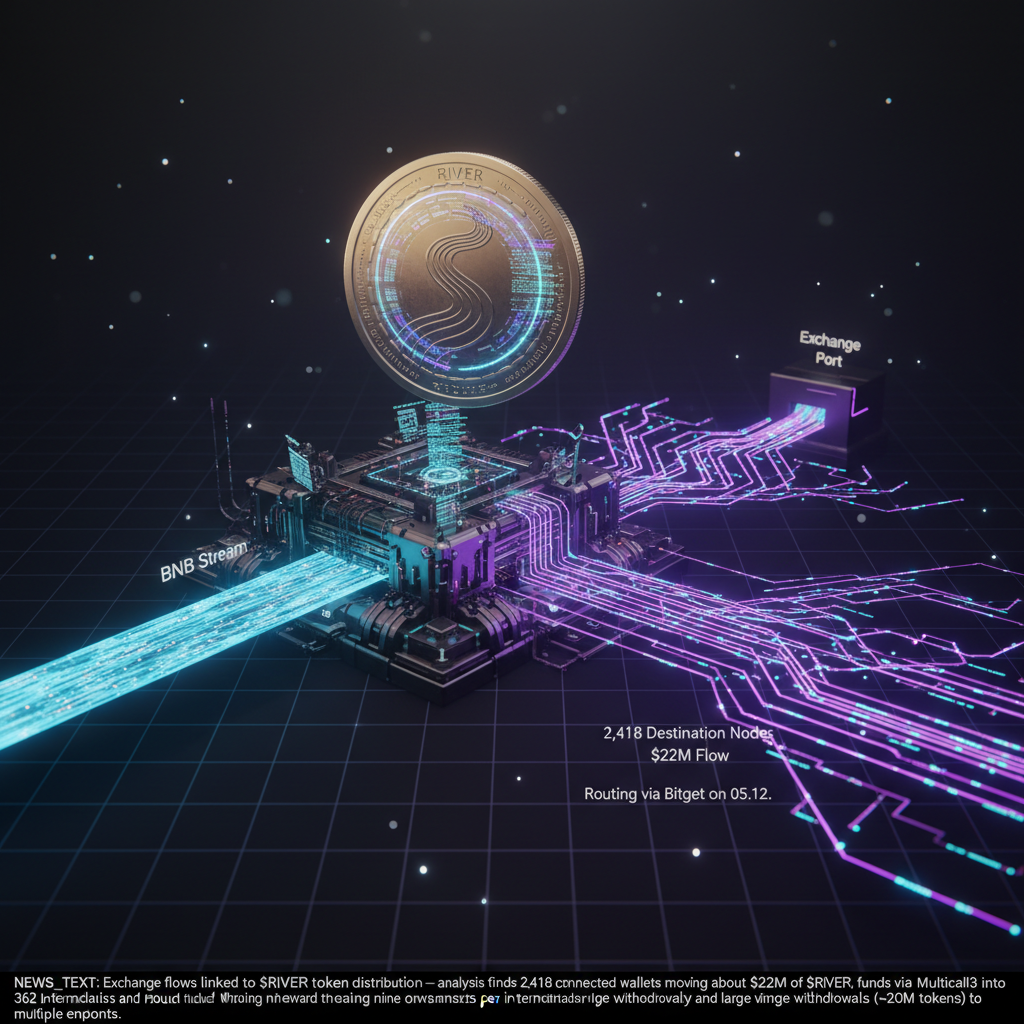

Analysis describes 2,418 connected wallets moving about $22M of $RIVER tokens, with core activity routed through Bitget on 05.12.

Tracing the transfers

The chain began with a single wallet receiving several BNB transfers from OKX, amounts that individually appeared modest on-chain.

Those BNB funds were split via a Multicall3 contract into 362 intermediary wallets, consolidating many operations into a single transaction record.

- Each intermediary executed a sequence of nine onward transfers, creating the final set of 2,418 destination wallets.

- The use of Multicall3 compressed multiple actions into one visible transaction in common explorers.

Withdrawals and market impact

On 05.12, roughly 2M tokens were withdrawn to five external addresses, followed by another 1M to two more wallets.

Withdrawals were staged to avoid sharp price moves, and later activity shows tokens being returned to Bitget after partial dispersal.

Following the second withdrawal, the $RIVER price increased about 15x, triggering substantial short-liquidation events and amplifying on-chain volatility.

Since a portion of the supply remained parked off-exchange, the available circulating supply tightened and contributed to price acceleration.

Attribution and outstanding questions

An analyst reviewing the flows states that either Bitget facilitated parts of the scheme or the observed movements reflect a recurring operational pattern on the platform.

Similar cases involving comparable exchange-linked flows have been reported previously, prompting questions about monitoring and withdrawal controls.

Investigators will likely examine whether internal controls permitted structured withdrawals and how exchange processes recorded those transfers.

Related posts